Create tomorrow's financial stability today.

Introduction

An annuity is a financial instrument issued and backed by an insurance company that provides guaranteed monthly income payments for the life of the contract, regardless of market conditions. You can customize an annuity based on a variety of options, including how long you think you’ll live, when you want your payments to start, and whether you want to leave your income stream to a beneficiary after your death.

Annuities can be optimized for income or long-term growth, but they are not short-term investment strategies. These products appeal to people whose objectives include long-term financial security, retirement income, diversification, and principal preservation.

Key Takeaways

- An annuity is an insurance product designed to provide consumers with guaranteed income for life.

- The type of annuity you purchase determines your future annuity payments.

- The primary benefits of buying an annuity include principal protection, the potential for guaranteed lifetime income and the option to leave money to your beneficiaries. Some annuities may also be optimized to help pay for long-term care.

What is an annuity?

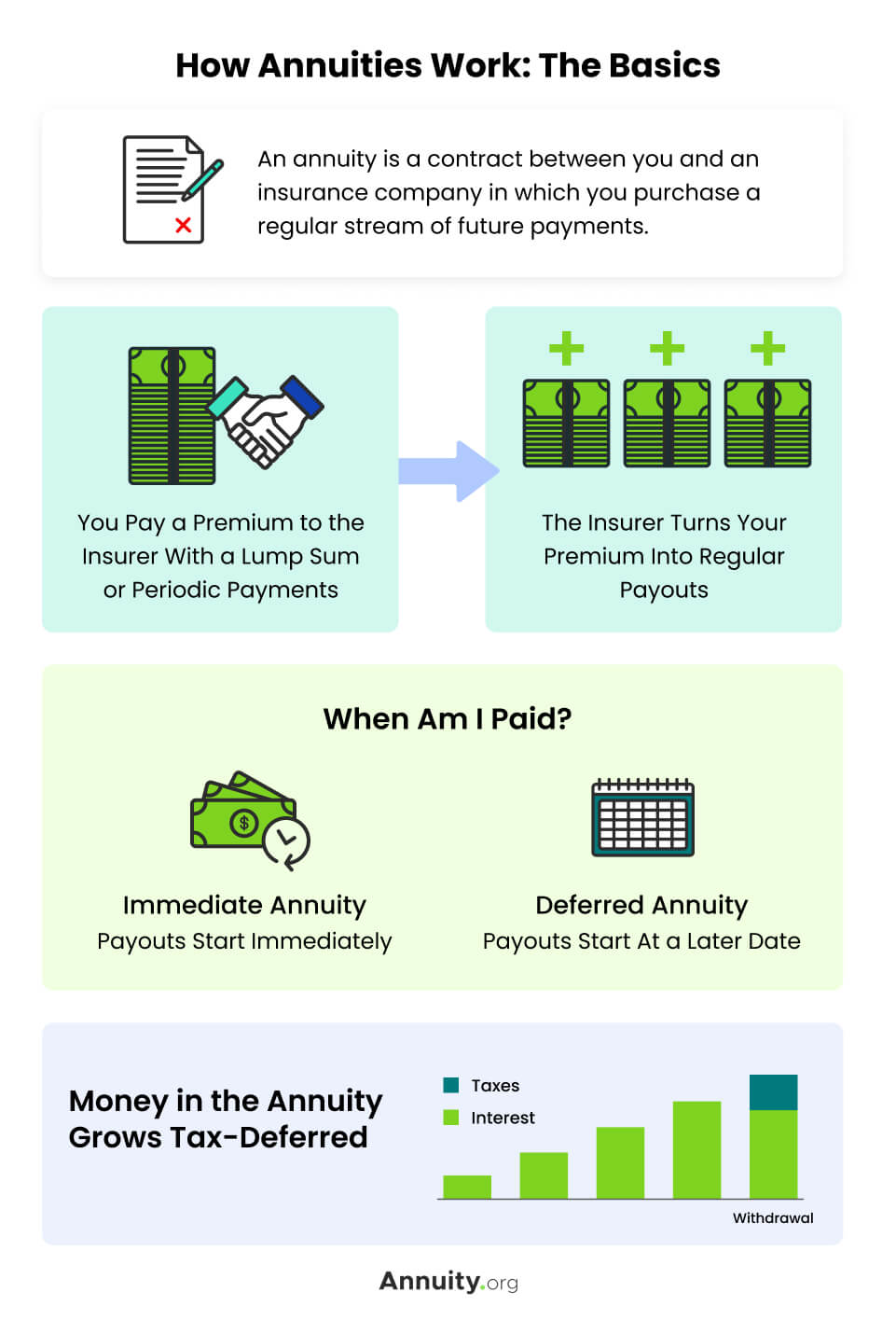

An annuity is a customizable contract issued by an insurance company that converts an investor’s premiums into a guaranteed fixed income stream.

More specifically, an annuity contract is a legally binding, written agreement between you and the insurance company that issues the contract. This contract transfers your longevity risk — the risk of you outliving your savings — to the insurance company. In exchange, you pay premiums as outlined in the contract.

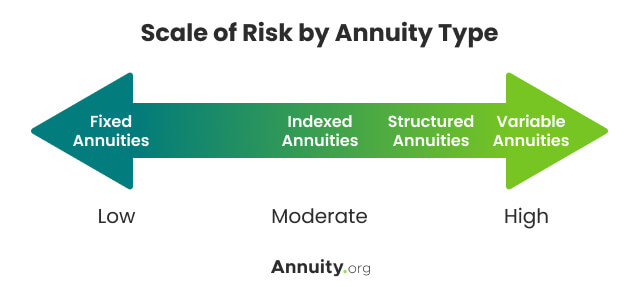

Types of Annuities

Different types of annuities exist to fit the diverse needs of the market. Your personal goals and objectives will determine the type of annuity that is right for you.

Fixed Annuities

GUARANTEED INCOME

Earns a guaranteed rate of interest for a set period of time. Rate of interest may be guaranteed for a set period of time or may fluctuate from anniversary to anniversary.

Fixed Indexed Annuities

GROWTH POTENTIAL

Earns interest based on a market index like the S&P 500. Doesn’t participate directly in the stock market and preserves premium. Guaranteed minimum rate of return.

Variable Annuities

FLEXIBLE INCOME

Earns interest through investments you select within the annuity. Does not guarantee a return but offers more growth potential.

How do annuities work?

Annuities work by converting a lump-sum premium into a stream of income that a person can’t outlive. Many retirees need more than Social Security and investment savings to provide for their daily needs.

Annuities are designed to supply this income through a process of accumulation and annuitization or, in the case of immediate annuities, lifetime payments guaranteed by the insurance company that begin within a month of purchase — no accumulation phase necessary.

In essence, when you buy a deferred annuity, you pay a premium to the insurance company. That initial investment will grow tax-deferred throughout the accumulation phase, typically anywhere from 10-30 years, based on the terms of your contract. Once the annuitization, or distribution, phase begins — again, based on the terms of your contract — you will start receiving regular payments.

Annuity contracts transfer all the risk of a down market to the insurance company. This means you, the annuity owner, are protected from market risk and longevity risk, that is, the risk of outliving your money.

To offset this risk, insurance companies charge fees for investment management, contract riders, and other administrative services. In addition, most annuity contracts include surrender periods during which the contract holder cannot withdraw money from the annuity without incurring a surrender charge.

Furthermore, insurance companies generally impose caps, spreads, and participation rates on indexed annuities, each of which can reduce your return.

An annuity contract can help you save for retirement or turn your savings into a stream of retirement income.

Schedule Your

Free Strategy Session.

During this call we will quickly discover where your financial opportunities are, where you want to go, and whether our expertise and strategies can help you get there. We can often determine if we are able to help in as few as 5 minutes.